LIFE & HEALTH HUB INSURANCE

(281) 688-6165

WELCOME HOME!

WHAT WE DO

LIFE INSURANCE

We help you find the right life insurance plan to protect what matters most. Leave a legacy, not a burden—get covered with confidence.

MEDICARE

We help you navigate Medicare with clarity and confidence.Get the benefits you deserve and the support you can count on.

HEALTH INSURANCE

We make health insurance easy to understand and simple to get.Affordable coverage for you and your family, backed by real support.

Can You Get Life Insurance if You Have Health Issues?

If you’ve been diagnosed with a health condition—big or small—you might be wondering, “Can I still get life insurance?” The good news is: Yes, you often can.

While health does play a role in the type and cost of life insurance you can get, having a medical condition doesn’t automatically mean you’ll be denied.

Let’s break down your options and what you can expect.

🩺 Yes, You Can Still Qualify for Coverage

Many life insurance companies work with people who have:

High blood pressure

Diabetes

Asthma

Anxiety or depression

Heart disease

A history of cancer

Other chronic conditions

Some plans may require a health questionnaire or medical exam, while others don’t.

💡 Tip: Every insurance company evaluates conditions differently. One might say no—while another says yes.

🔎 Types of Life Insurance for People with Health Conditions

1. 🧾 Standard Term or Whole Life

If your condition is well-managed and not considered high-risk, you may still qualify for traditional coverage—possibly at a slightly higher rate.

2. 📋 Simplified Issue Life Insurance

No medical exam required. You just answer a few health questions. These policies are quicker to get approved and great for moderate health concerns.

3. ⚰️ Guaranteed Issue Life Insurance

No health questions. No medical exam. Acceptance is guaranteed (usually for smaller policies like final expense coverage). Perfect for those with more serious conditions.

💰 Will It Cost More?

It depends. Some policies may have higher premiums if your condition is more serious or not well-managed. But many people are surprised to find that the cost is still affordable—especially with the right guidance.

💡 Tip: The earlier you apply, the better your chances of locking in a good rate.

👥 Why It’s Still Worth It

Even if you pay a little more, life insurance still protects your family from:

Funeral and burial costs

Medical bills

Unpaid debts

Loss of your income

The financial stress of losing a loved one

And that peace of mind? Priceless.

🎯 Bottom Line

Don’t assume you can’t get life insurance just because you have a health condition. You have options—and the right policy could be just a few questions away.

🗓️ Let’s find a plan that works for you.

👉 Get a Free Life Insurance Quote – No Exam Required

Fast, friendly, and no pressure. Just real answers.

Insurance Can Be Tricky, But We Can Help!

We understand that navigating insurance can be challenging. That's why we are committed to educating and empowering our clients to make the best decisions for their insurance coverage. Whether you need help with, Medicare, Life Insurance, or Marketplace Coverage, our team is ready to assist you.

INSURANCE MADE EASY!

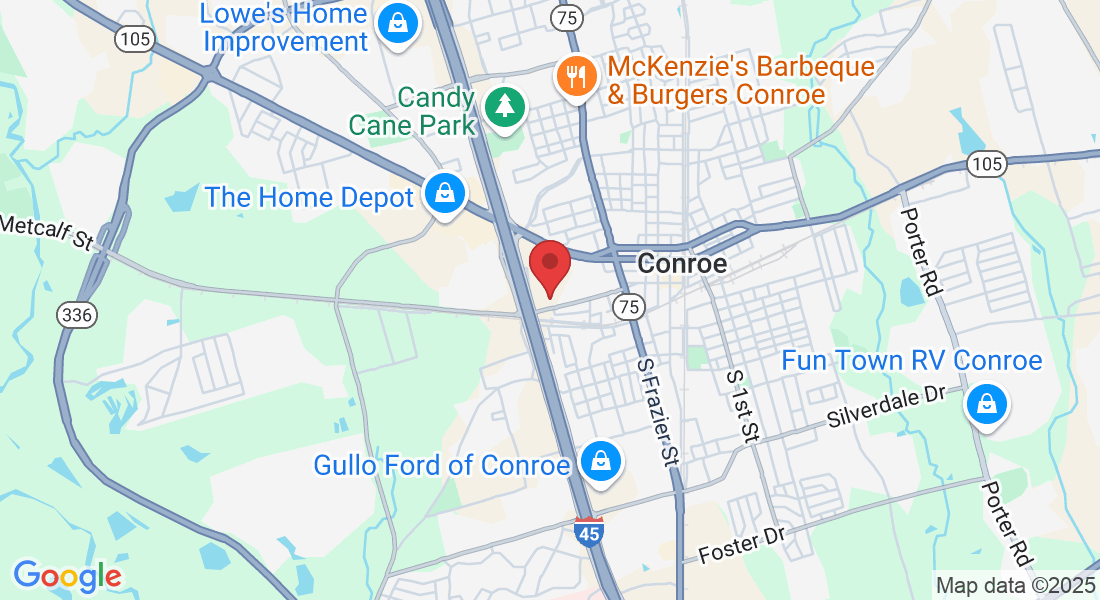

We are located at 100 N Interstate 45 FWY, Suite 460, Conroe, Texas 77301 and our office hours are from 9AM - 5PM. You can reach us at (281) 688-6165 or you can fill out our contact form on our contact page and our front desk will reach out to you.

©Copyright | lifeandhealthhub.com 2024 All Right Reserved

Facebook

Instagram

Youtube